Income from RM5000001. 19 rows Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000.

Updated Guide On Donations And Gifts Tax Deductions

And you must keep the receipt of the donation.

. To legislate this proposal the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2020 PU. EIS is not included in tax relief. Special relief for domestic travelling expenses until YA 2022.

EPF tax relief limit revised to RM4000 per year. A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Purchase of Various Print Materials.

If youre paying your own way through college or university you might be entitled to a tax exemption. Repair and renewal expenses are claimed as tax deductions pursuant to Section 331c of the ITA. 62019 Tax Treatment on Expenditure for Repairs and Renewals of Assets.

YA 20182019 Tax RM on excess 5000 0 1 20000 150 3. On the First 5000. The Rules provide a deduction capped at RM15000 per YA to a resident person who has incurred and paid the following fees in the basis period for that YA.

A 162 were gazetted on 19 May 2020. The IRB has issued Public Ruling No. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Income from RM2000001. Box 10192 50706 Kuala Lumpur Malaysia Tel.

Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below. Income from RM500001. On the First 5000.

Removed YA2017 tax comparison. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000.

8 EPF contribution removed. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Income from RM3500001.

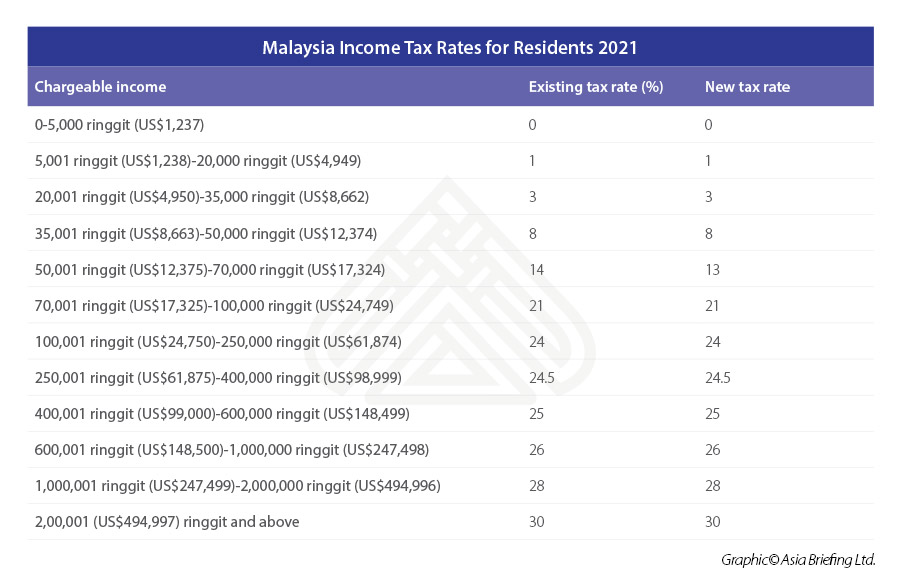

These are the types of personal reliefs you can claim for the Year of Assessment 2021. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Malaysia Non-Residents Income Tax Tables in 2019.

Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid. Up to RM7000 life insurance.

Updated PCB calculator for YA2019. Life insurance and EPF including not through salary deduction. Jalan Rakyat Kuala Lumpur Sentral PO.

Insurance other policies. Fines and penalties are generally not deductible. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule.

For 2021 tax year. Taxable Income MYR Tax Rate. Assessment Year 2018-2019 Chargeable Income.

Tax rates range from 0 to 30. Income tax in Malaysia is imposed on income. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of. Self and dependent relatives. On the First 5000 Next 15000.

For pensionable public servants. Calculations RM Rate TaxRM 0 - 5000. 20192020 Malaysian Tax Booklet.

In Malaysia you may qualify for a tax deduction of up to RM 7000 if you are pursuing higher education specifically if you are pursuing a degree at the Masters or Doctorate level. The deduction is limited to 10 of the aggregate income of that company for a year of assessment. Employment Insurance Scheme EIS deduction added.

Further tax deduction for employers hiring senior citizens or ex-convicts Further deduction will be given to employers on remuneration paid to full-time employees who are senior citizens aged above 60 years old or ex-convicts provided the monthly remuneration does not exceed RM4000. PCB EPF SOCSO EIS and Income Tax Calculator 2022. It incorporates key proposals from the 2020 Malaysian Budget.

2019 to 31 December 2019.

Latest News Chartered Accountant Latest News Accounting

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

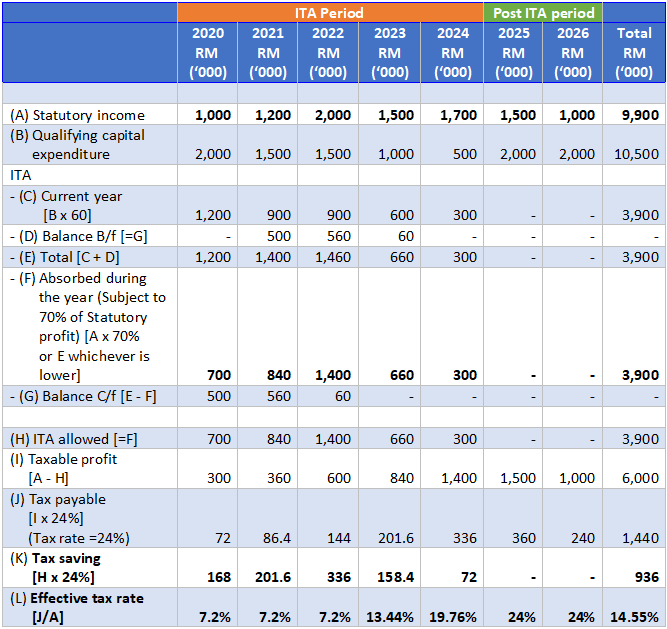

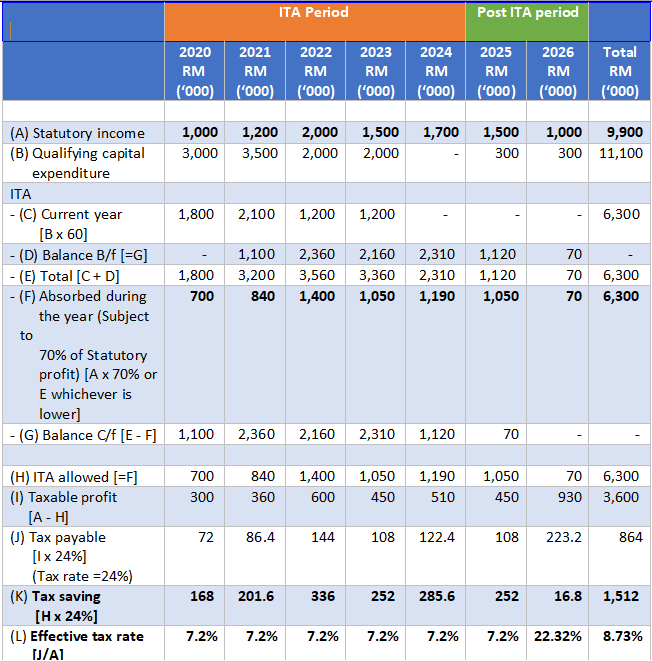

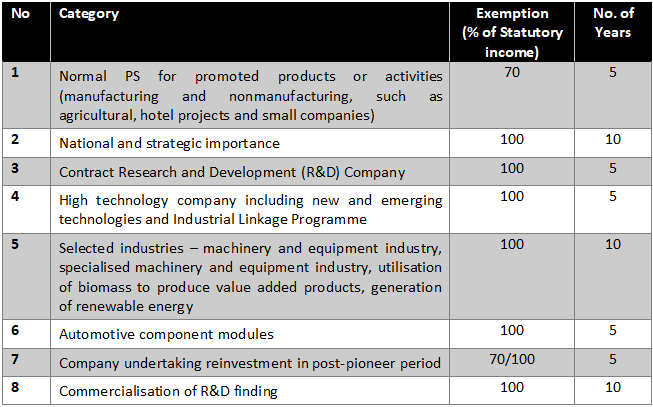

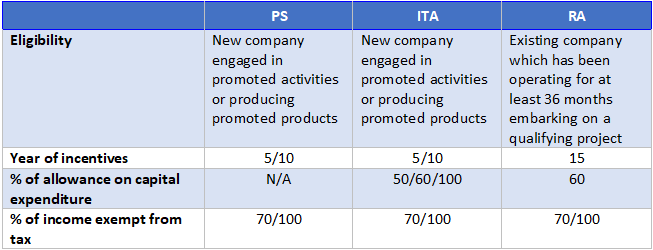

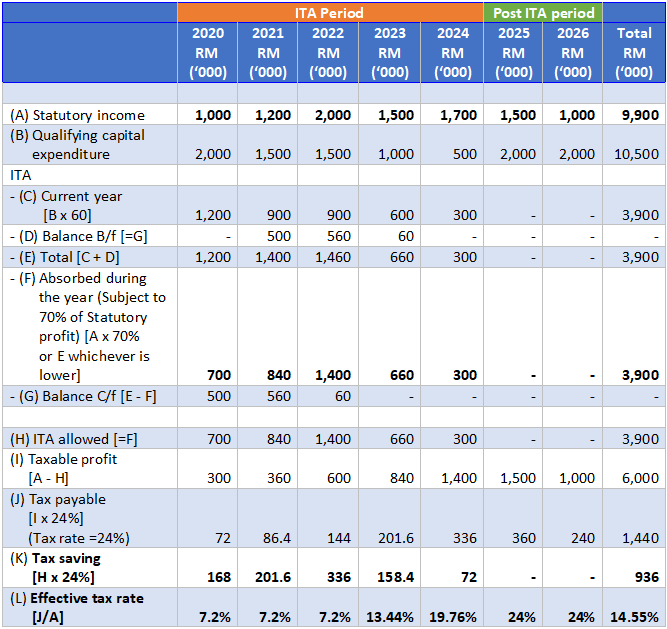

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Income Tax Rate 2021 Tax Bracket Calculator

Malaysia Payroll What Is Pcb Mtd

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Personal Income Tax Malaysia Guide For Ya2020 Excel Template Included Life Of A Working Adult

Updated Guide On Donations And Gifts Tax Deductions

Tax Write Offs For Athletes Awm Capital Awm Capital

Double Tax Agreements In Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia